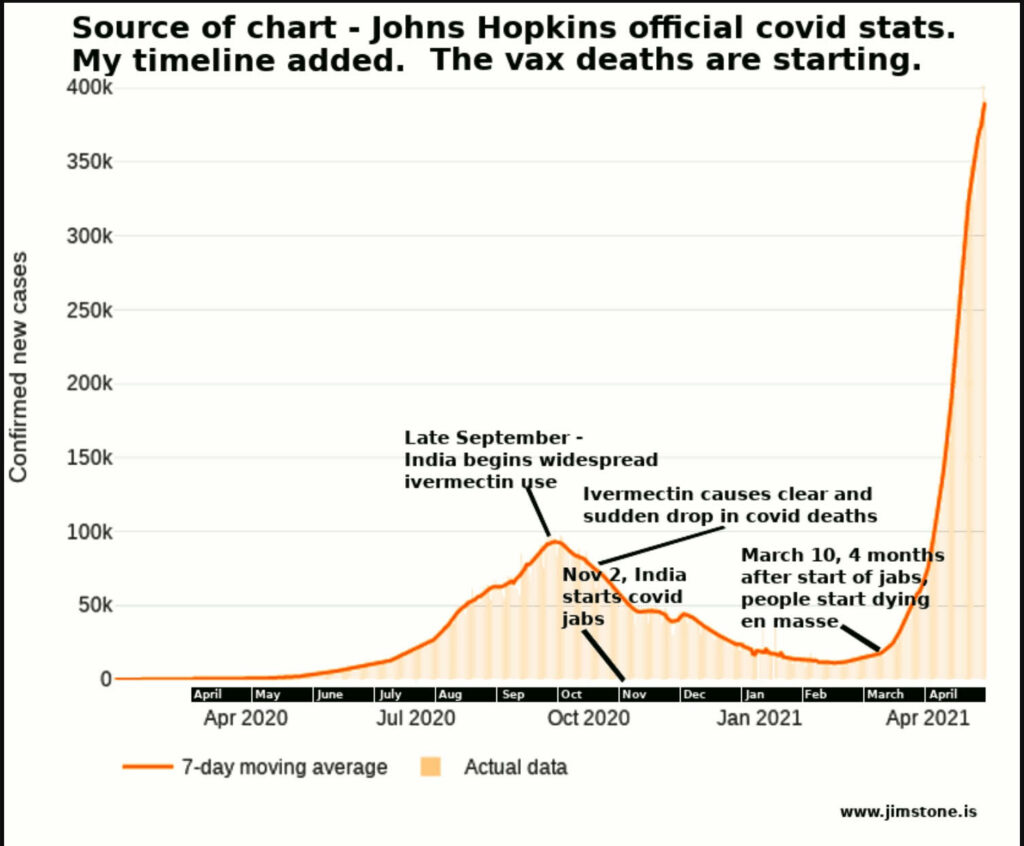

The COVID-19 Sham: Global Elite Caught Red-Handed Committing Genocidal Crimes Against Humanity

The COVID-19 Sham: Global Elite Caught Red-Handed Committing Genocidal Crimes Against Humanity

When you inject a known toxin into a person, you are actually injecting an agent of death. David Martin, PhD., intellectual property-patent expert, U. of Virginia School of Medicine professor[1]

Over a half dozen years ago I wrote a Global Research article entitled “The Globalists’ New World Order: Soft and Hard Kill Methods. An Unknown and Uncertain Future.”[2] Aside from all-out manmade nuclear war or cataclysmic natural disasters such as enormous volcanic eruptions, large meteors colliding with earth or another Planet X pass-by,[3] the globalists’ latest fast kill method – promised for years by the ambassador of doom and gloom himself Bill Gates,[4] is now unfolding at breakneck speed.

Continue reading “Joachim Hagopian: The COVID-19 Sham: Global Elite Caught Red-Handed Committing Genocidal Crimes Against Humanity”