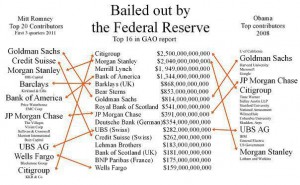

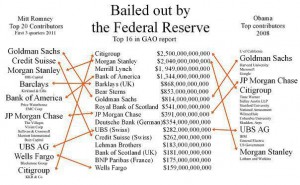

Source and More Data

Continue reading “Graphic: GAO Audit In One Graphic – Banks Buying Politicians”

Source and More Data

Continue reading “Graphic: GAO Audit In One Graphic – Banks Buying Politicians”

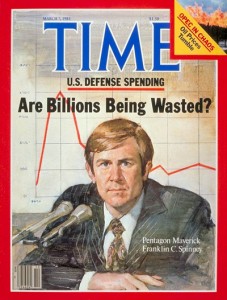

New report released by the Institute for Economics & Peace analyses the macroeconomic effects of US government spending on wars and the military since World War II.

The IEP’s latest report, Economic Consequences of War on the US Economy, analyses the macroeconomic effects of US government spending on wars and the military.

The report studies five periods – World War II, the Korean War, the Vietnam War, the Cold War, and the Afghanistan/Iraq wars – exposing the effect of war financing on debt, consumption, investment, jobs, taxes, government deficits, and inflation.

The findings of the report show devastating trends for US tax, debt and deficit debates.

Download the report here

Key findings

The U.S. has paid for its wars either through debt [World War II, Cold War, Afghanistan/Iraq], taxation [Korean War] or inflation [Vietnam]. In each case, taxpayers have been burdened, and private sector consumption and investment have been constrained as a result.

Report highlights

The report shows the following economic indicators experiencing negative effects either during or after the conflicts:

The higher levels of government spending associated with war tends to generate some positive economic benefits in the short-term, specifically through increases in economic growth occurring during conflict spending booms. However, negative unintended consequences occur either concurrently with the war or develop as residual effects afterwards thereby harming the economy over the longer term.

Phi Beta Iota: There appears to be a continued reluctance to address the real causes of our terrible situation: corruption across the board. No amount of intellectual posturing, whether in a book or in a conference, is a substitute for full transparency and the truth — the whole truth. The lack of integrity across all eight tribes — academia, civil society, commerce, government, law enforcement, media, military, and non-government/non-profit — is the ROOT CAUSE of our collapse.

See Also:

Journal: Politics & Intelligence–Partners Only When Integrity is Central to Both

2012 THE OPEN SOURCE EVERYTHING MANIFESTO: Transparency, Truth & Trust

The Koch Brothers, The Cato Institute, And Why Nations Fail

Simon Johnson, Baseline Scenario, 8 March 2012

A dispute has broken out between the Cato Institute, a leading libertarian think tank, and two of its longtime backers – David and Charles Koch. The institute is not the usual form of nonprofit but actually a company with shares; the Koch brothers own two of the four shares and are arguing that they have the right to acquire additional shares and thus presumably exert more control. The institute and some of its senior staff are pushing back.

According to Edward H. Crane, the president and co-founder of Cato, “This is an effort by the Kochs to turn the Cato Institute into some sort of auxiliary for the G.O.P.” Bob Levy, chairman of the Cato board, told The Washington Post: “We would take closer marching orders. That’s totally contrary to what we perceive the function of Cato be.”

Far from being just an unseemly row between prominent personalities on the right, this showdown reflects a much deeper set of concerns for American politics and society. And it raises what I regard as the central question of an important book, “Why Nations Fail: The Origins of Power, Prosperity and Poverty,” by Daron Acemoglu and James Robinson that will be published on March 20.

Continue reading “Chuck Spinney: Koch Brothers, Cato, Why Nations Fail”

Robert Steele has for some time been saying that “The truth at any cost lowers all others costs.” He has also been focusing on the importance of intelligence with integrity. Among all governments, only Iceland appears to be serious about dealing with the financial crisis as it should be dealt with: as a criminal conspiracy enabled by all of the parties in both public and private sectors who sacrificed their integrity and betrayed the public trust.

Corporations operate under public charters. It is difficult to police the corporations when the governments have themselves become criminalized, but the tide is turning — the public is beginning to recognize that governments lack integrity and intelligence and cannot be trusted — in their present form — to manage the public interest.

When Goldman Sachs goes out of business the healing can begin. Slamming PWC is a good start.

Old Landsbanki to sue PriceWaterhouseCoopers for ‘deliberate’ auditing errors

You Don't Need a Cyber Attack to Take Down The North American Power Grid

The Obama administration simulated a cyber attack on New York City's power supply in a Senate demonstration aimed at winning support for legislation to boost the nation's computer defenses. Senators from both parties gathered behind closed doors in the Capitol Wednesday for the classified briefing attended by Homeland Security Secretary Janet Napolitano, FBI Director Robert Mueller and other administration officials. The mock attack on the city during a summer heat wave was “very compelling,” said Sen. Susan Collins, R-Maine, who is co-sponsoring a cybersecurity bill supported by President Barack Obama. “It illustrated the problem and why legislation is desperately needed,” she said as she left the briefing. Bloomberg.

The US defense industry is in a full court press to get tens of billions in funding for cyberwarfare.

To get that funding, they need to dramatize the potential threat of cyberwarfare. Here's how. The central method of attack in cyberwarfare is systems disruption. Systems disruption is a way to break networks to achieve extremely high levels of damage (or, in financial terms, high ROIs). One of the best ways to demonstrate that type of attack is through a disruption of the power supply (usually with NYC as a target).

Two John Robb posts, comment, and see also — university grants at risk.

What Would a “Good” Banking System Look Like? Banks Weren’t Meant to Be Like This

MICHAEL HUDSON

CounterPunch, Weekend Edition January 27-29, 2012

In medieval times, wealthy bankers lent to kings and princes as their major customers. But now it is the banks that are needy, relying on governments for funding – capped by the post-2008 bailouts to save them from going bankrupt from their bad private-sector loans and gambles.

Yet the banks now browbeat governments – not by having ready cash but by threatening to go bust and drag the economy down with them if they are not given control of public tax policy, spending and planning. The process has gone furthest in the United States. Joseph Stiglitz characterizes the Obama administration’s vast transfer of money and pubic debt to the banks as a “privatizing of gains and the socializing of losses. It is a ‘partnership’ in which one partner robs the other.” Prof. Bill Black describes banks as becoming criminogenic and innovating “control fraud.” High finance has corrupted regulatory agencies, falsified account-keeping by “mark to model” trickery, and financed the campaigns of its supporters to disable public oversight. The effect is to leave banks in control of how the economy’s allocates its credit and resources.

If there is any silver lining to today’s debt crisis, it is that the present situation and trends cannot continue. So this is not only an opportunity to restructure banking; we have little choice. The urgent issue is who will control the economy: governments, or the financial sector and monopolies with which it has made an alliance.

Fortunately, it is not necessary to re-invent the wheel. Already a century ago the outlines of a productive industrial banking system were well understood. But recent bank lobbying has been remarkably successful in distracting attention away from classical analyses of how to shape the financial and tax system to best promote economic growth – by public checks on bank privileges.

How banks broke the social compact, promoting their own special interests

People used to know what banks did. Bankers took deposits and lent them out, paying short-term depositors less than they charged for risky or less liquid loans. The risk was borne by bankers, not depositors or the government. But today, bank loans are made increasingly to speculators in recklessly large amounts for quick in-and-out trading. Financial crashes have become deeper and affect a wider swath of the population as debt pyramiding has soared and credit quality plunged into the toxic category of “liars’ loans.”

The first step toward today’s mutual interdependence between high finance and government was for central banks to act as lenders of last resort to mitigate the liquidity crises that periodically resulted from the banks’ privilege of credit creation. In due course governments also provided public deposit insurance, recognizing the need to mobilize and recycle savings into capital investment as the industrial revolution gained momentum. In exchange for this support, they regulated banks as public utilities.

Over time, banks have sought to disable this regulatory oversight, even to the point of decriminalizing fraud.